Many people consider getting a life insurance policy as part of their estate plan to leave something behind for their loved ones. Even if you name a beneficiary on your life insurance policy, that may not be the best approach to ensure the money goes where you want it to. Trust can help with that. You can reduce the likelihood of paying estate taxes and increase the flexibility of your beneficiaries by transferring your life insurance policy to a trust. Beneficiaries and distribution terms can be outlined in the trust, which can also shield the policy from creditors and keep the money out of probate. If you have a sizable estate and are concerned about estate taxes, consider putting the insurance into a trust.

Advantages of Using a Trust to Own Your Life Insurance Policy

Owning a life insurance policy through a trust can help you avoid probate, save estate taxes, shield assets from creditors, and keep your loved ones out of court. The benefits of having your life insurance held in trust

Control Over Distribution

Having a trust as the owner of your life insurance policy allows you to direct the distribution of the proceeds. Upon your passing, the policy's designated beneficiary will automatically receive the policy's payout. Yet, if you establish a trust, you can dictate the terms of distribution and stipulate whatever restrictions you like.

You might, for instance, desire to provide for your children's college education or guarantee your spouse a steady income after your death. A trust can be established to avoid probate and preserve the assets from creditors while still allowing for the distributions to be made.

Tax Planning

A trust can be a useful tax planning instrument, which is another reason to consider making it the owner of your life insurance policy. If you have a sizable estate and are worried about estate taxes, consider putting the insurance in a trust. Additionally, the trust might be structured to lessen the policy funds' exposure to income and capital gains taxes. To provide your spouse with tax-free income from the policy's proceeds, you can, for instance, establish a trust. This can be extremely helpful if your spouse has a lower tax bracket than you. In addition, the trust can be set up so that selling the insurance will result in fewer capital gains taxes.

Protection from Creditors

The money from your life insurance policy can be shielded from creditors if a trust owns the policy. Just designating a beneficiary on your policy won't protect the money from the beneficiary's debtors. However, if the policy is held in a trust, the money is usually safe against lawsuits and other claims.

Probate Avoidance

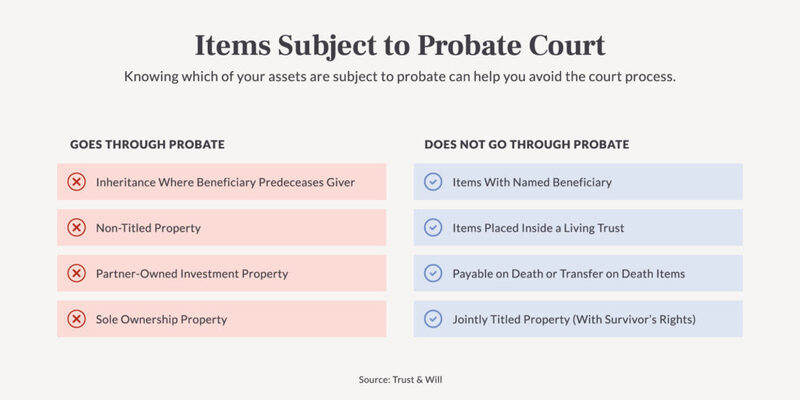

Last, you can keep your life insurance proceeds out of probate by transferring ownership to a trust. Probate is the legal procedure by which an individual's assets are distributed after death following their will. This procedure's time, money, and public nature might be difficult for your loved ones. The policy proceeds are distributed per the terms of the trust instrument, which bypasses the probate process. Without the involvement of the judicial system, this can facilitate the swift and orderly transfer of assets to your loved ones.

Conclusion

One can avoid probate, save estate taxes, and shield assets from creditors and certain beneficiaries' inheritances by having a life insurance policy held in trust. But there are a variety of trusts to choose from, each with its pros and cons, so it's important to weigh your circumstances and priorities before selecting whether or not to trust the owner of your life insurance policy. The advantages of using a trust should be weighed against its complexity, tax ramifications, and the time and money required to set it up and administer it. Suppose you want to ensure that your life insurance policy and trust are set up to serve your beneficiaries best after you're gone. In that case, consulting with an estate planning solicitor or financial advisor with experience in this area is a good idea.