What Is a REIT? A Real Estate Investment Trust (REIT) is a popular way for people to invest in a portfolio of different real estate assets. REITs are made so that investors can get into the real estate market without owning or managing their own properties. REITs combine the money from many investors to buy office buildings, shopping centers, apartments, hotels, and other real estate types. They might also invest in mortgages, giving them another way to make money. REITs must provide their shareholders with at least 90% of their taxable income as dividends. This makes them a popular choice for investors who want to make money. REITs can be publicly traded, meaning their shares are listed on a stock exchange, or they can be non-traded, meaning their claims are not listed and are sold less often.

History of REITs

The idea of REITs has been around since the early 1900s. In 1960, the US Congress passed a law that allowed REITs to be made the way they are today. Since then, REITs have become more popular and a significant part of the investment world. REITs are now used in many countries, such as the United States, Canada, Australia, Singapore, and Japan.

Structure of REITs

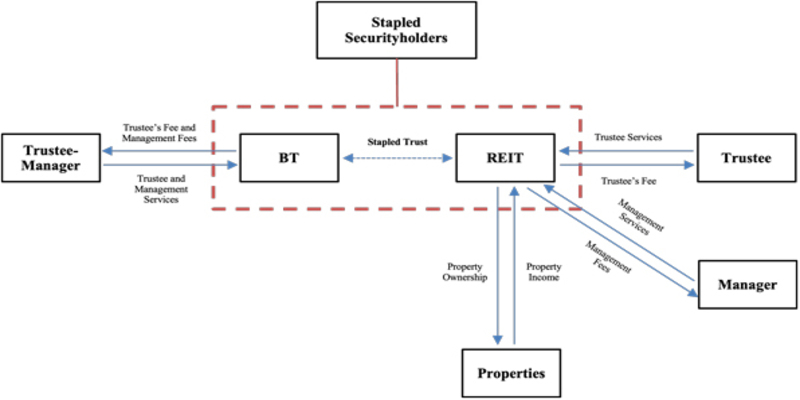

REITs are structured as companies that own and operate real estate properties or as companies that own and operate mortgages. The three main categories of real estate investment trusts are mortgage REITs, equity REITs, and hybrid REITs. Equity REITs will own and operate commercial and residential properties that generate income for their investors. These types of REITs generate income through rental payments from tenants. Mortgage REITs, on the other hand, invest in mortgages, providing an additional source of income. Hybrid REITs combine elements of both equity and mortgage REITs, investing in both real estate properties and mortgages.

Benefits of Investing in REITs

Investing in REITs offers several benefits, including portfolio diversification, potential for regular income, and potential for capital appreciation. In addition, REITs offer liquidity, meaning they can be bought and sold on stock exchanges, allowing investors to enter and exit their positions quickly.

- Diversification: Investors may add real estate to their portfolios via REITs. A diversified portfolio should include real estate assets because of their low correlation to more common asset classes like equities and fixed income.

- Income: REITs typically generate income through tenant rental payments or mortgage interest payments. By law, REITs must distribute at least 90% of their taxable income to shareholders as dividends. This means that investors can earn regular income from their REIT investments.

- Capital Appreciation: Besides income, REITs offer the potential for capital appreciation. As real estate values increase, the value of the underlying REIT investments can also increase, potentially providing investors with capital gains.

- Liquidity: REITs are listed on stock exchanges, meaning they can be easily bought and sold, providing investors with liquidity.

- Tax Benefits: REITs can provide investors with tax benefits. Because they are structured as pass-through entities, they are not subject to corporate income tax. Instead, income is taxed at the individual investor level, typically at a lower tax rate than corporate income tax.

Potential Risks of Investing in REITs

While REITs offer several benefits, they also carry some potential risks. Some risks associated with investing in REITs include interest rate, tenant default, and property value risk.

- Interest Rate Risk: REITs are often sensitive to changes in interest rates. As interest rates rise, the cost of borrowing increases, potentially reducing the profitability of real estate investments.

- Tenant Default Risk: REITs generate income through rental payments from tenants. If tenants default on their rent payments, REITs may experience a decline in revenue, potentially impacting the value of their underlying investments.

- Property Value Risk: REITs invest in real estate assets subject to changes in property values. Economic conditions, such as recessions, can lead to a decline in property values, potentially impacting the value of the underlying REIT investments.

Conclusion

REITs allow investors to access the real estate market without having to own or manage properties directly. They offer several benefits, including portfolio diversification, potential for regular income, potential for capital appreciation, and liquidity. However, they also carry some potential risks, including interest rate, tenant default, and property value risks. Investors can invest in REITs by purchasing shares of individual REITs on a stock exchange or by investing in REIT mutual funds or ETFs. By understanding the different types of REITs and the risks and benefits associated with investing in them, investors can make informed decisions about whether or not to include REITs in their investment portfolios.